Transform bank reconciliation with global, multi-bank connectivity

Sage have partnered with AccessPay, the leading specialists in global bank connectivity.

AccessPay connects your Sage platform with all your global banks. Unlock the power of bank connectivity for automated bank statement retrieval: Automate your finance and treasury operations, effortlessly increase the frequency and accuracy of your reconciliation process, and reduce error-based risks.

Multi-bank connectivity

Automate your access to rich and consistent transaction data through a secure connection to all your banks. AccessPay leverages the SWIFT network (11,000+ banks) to provide you with full coverage of your banks and accounts.

Uncover value-add

An automated connection to your banks enables auto-reconciliation within Sage. Increasing the frequency, efficiency and reliability of your reconciliation workflow, whilst saving hours of manual effort downloading and reformatting statement data.

De-risk critical processes

Downloading bank statements manually increases the risk of internal and external fraud and human error. AccessPay removes these risks by automating the process and removing opportunities to manipulate data.

Your future-proof reconciliation solution

Your bank statement data, always accurate and retrieved as frequently as you need.

AccessPay and Sage continuously improve bank connectivity for our customers, enhancing the offering through additional file formats (like BAI2) and establishing direct connections with regional banks.

Want to see how it works? Watch the demo to experience effortless bank statement retrieval, powered by AccessPay.

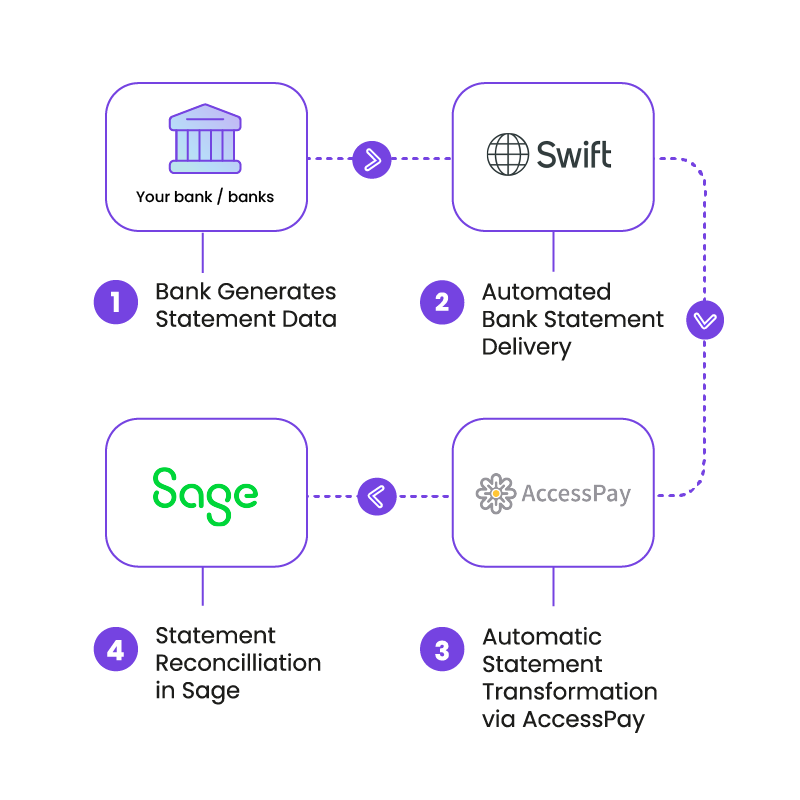

How it works

AccessPay connects to your banks and accounts via the SWIFT bank network. It receives daily MT messages (MT940) or CAMT.053 format statements from your connected bank accounts, providing the rich bank statement data required for accurate auto-reconciliation.

AccessPay instantly transforms this bank data into the correct format, before it is automatically delivered to Sage via API.

Get in touch to connect your banks with Sage*

To access this service, complete the form and an AccessPay representative will contact you within ONE business day to discuss fees and next steps.

*fees applicable

About AccessPay

AccessPay breaks down siloes across finance and treasury, helping organisations like yours solve key challenges around reducing risk and scaling connectivity to your key banking partners.

As experts in corporate-to-bank connectivity, we help thousands of multi-banked corporates establish direct connections between core finance applications and their banks. Delivered by a team of specialists, who build transformative solutions that embed access to corporate banking data and services within the daily workflows of our corporate clients.